Welcome to your modern guide to financial abundance. This resource is designed for anyone ready to build lasting wealth through both mindset mastery and strategic action. We’re not here to sell dreams—we’re here to show you how mindset, behavior, and tools work together to generate real financial growth in today’s rapidly evolving world.

Chapter 1: The New Definition of Financial Abundance

Redefining Wealth in a Modern World

If you ask ten people what “wealth” means, you’ll get ten different answers.

To some, wealth is a seven-figure net worth. To others, it’s being debt-free. For many, it’s simply having enough to stop living paycheck to paycheck.

But in 2025, financial abundance isn’t just about numbers—it’s about peace of mind, options, and autonomy.

“Abundance is not something we acquire. It is something we tune into.”

— Wayne Dyer

Financial abundance is when you can meet your needs, plan your future, and still have room to dream, grow, and give. It’s the quiet confidence that comes from knowing you’re in control of your financial life—even if you’re not wealthy yet by traditional standards.

Why the Old Definition of Wealth No Longer Works

Historically, wealth was defined by accumulation—how much land, gold, or money you had. The bigger the number, the wealthier you were.

But in an economy shaped by automation, remote work, social media, and inflation, abundance is more fluid. You may not own property yet, but you could own digital assets or have income from five different platforms. You might be debt-free, investing modestly, and still feel more abundant than someone earning six figures but drowning in lifestyle debt.

Here’s what’s outdated:

- Measuring success solely by salary

- Living to impress instead of living to progress

- Believing wealth is limited or reserved for the lucky

Here’s what’s current:

- Building freedom through financial literacy

- Creating multiple income streams—even if they start small

- Prioritizing well-being over status symbols

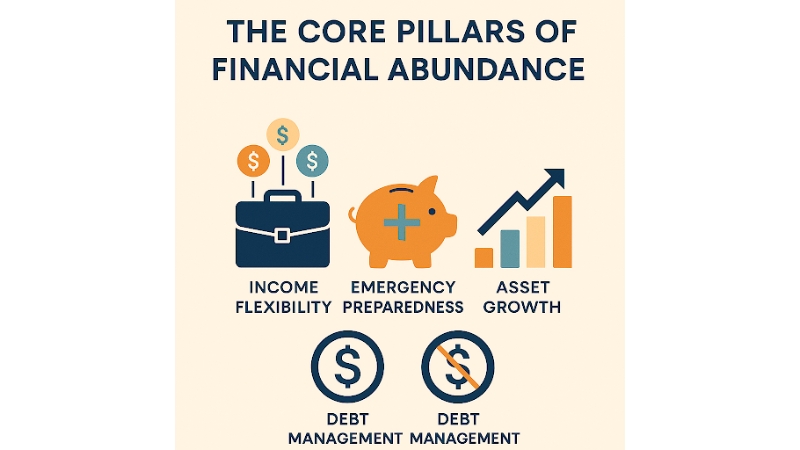

The Core Pillars of Financial Abundance

Let’s explore what modern financial abundance really looks like. Think of these as your foundational pillars:

1. Income Flexibility

In a post-pandemic world, job security is no longer guaranteed. Layoffs, AI disruption, and industry shifts are real. Having only one source of income is risky.

That’s why modern abundance includes:

- A primary income source (job, business, or contract work)

- A side hustle (freelance, creative, or gig-based)

- Passive income (dividends, royalties, rental, or digital products)

Example:

Tina is a marketing consultant who earns $60,000 annually. She also tutors students online for $500/month and sells a Notion template that brings in $200/month. While none of these alone makes her rich, together they form a resilient, diversified income web.

2. Emergency Preparedness

Abundance isn’t just about how much you make—it’s about how well you can withstand the unexpected.

An emergency fund (3–6 months of living expenses) is the financial equivalent of a safety net. It reduces anxiety, gives you options, and prevents you from falling into high-interest debt when life surprises you.

3. Asset Growth

Wealth doesn’t come from saving alone—it grows through investments.

If your money is just sitting in a savings account earning 1% while inflation rises at 4%, you’re quietly losing buying power. Even small monthly investments in index funds, ETFs, or real estate crowdfunding platforms can compound over time.

“Money is a terrible master but an excellent servant.”

— P.T. Barnum

With the rise of fractional shares, investing is no longer just for the rich. Anyone can begin with as little as $5.

4. Debt Management

Financial abundance is not about being anti-debt—it’s about being in control of your debt.

There’s a difference between:

- Toxic debt: High-interest credit cards, buy-now-pay-later traps, payday loans.

- Strategic debt: A low-interest mortgage, a business loan, or student debt with a strong ROI.

Toxic debt keeps you stuck. Strategic debt can be a tool.

Your first milestone toward abundance? Paying off bad debt. Your next? Using good debt wisely.

5. Freedom of Choice

True abundance gives you options:

- The option to change jobs without desperation.

- The option to help a loved one in need.

- The option to take a sabbatical, pursue a passion, or move cities.

The most powerful form of wealth is time and autonomy. A healthy financial foundation buys both.

What Financial Abundance Is Not

Let’s bust a few myths:

- It’s not about being rich overnight.

- It’s not about manifesting without action.

- It’s not about depriving yourself to hoard savings.

It’s about being conscious, strategic, and self-aware with your money.

Where You Are Now, and Where You Can Go

Take a moment. How would you describe your current financial state?

- Stressed? Stuck? Surviving?

- Stable but not thriving?

- Growing but inconsistent?

- Confident and building?

No matter where you are, financial abundance is a direction, not a destination.

This book will give you the tools, habits, and mindset shifts to move from uncertainty to empowerment.

Chapter 2: Building a Resilient Wealth Mindset

The Money Game Is Mental First

Before you earn, save, or invest a dollar, your mind is already playing a role.

Wealth starts in the mind long before it appears in your bank account. That’s why the most financially successful people often share more than income levels—they share a mindset that is adaptable, disciplined, and opportunity-oriented.

It’s not just about knowing what to do. It’s about thinking in ways that naturally lead to growth.

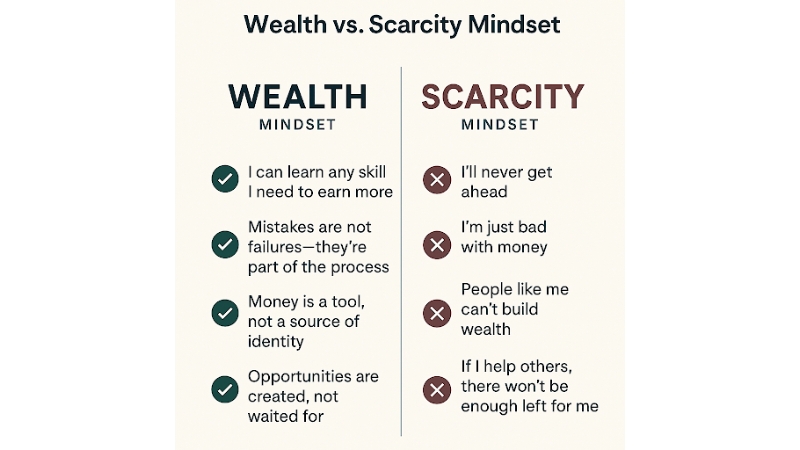

What Is a Wealth Mindset?

A wealth mindset is a way of thinking that drives smart decisions around money, time, and value. It doesn’t mean you ignore reality or pretend money doesn’t matter—it means you train your thoughts to serve your long-term goals.

Here’s what a wealth mindset sounds like:

- “I can learn any skill I need to earn more.”

- “Mistakes are not failures—they’re part of the process.”

- “Money is a tool, not a source of identity.”

- “Opportunities are created, not waited for.”

Now contrast that with a scarcity mindset, which often sounds like:

- “I’ll never get ahead.”

- “I’m just bad with money.”

- “People like me can’t build wealth.”

- “If I help others, there won’t be enough left for me.”

If you find yourself resonating with the second group, don’t worry. Mindsets aren’t permanent. They’re patterns. And patterns can be rewritten.

Why Your Mindset Might Be Holding You Back

1. Childhood Programming

Many of our money beliefs come from what we saw and heard growing up. If your household constantly said things like:

- “Money doesn’t grow on trees.”

- “We can’t afford that.”

- “Rich people are greedy.”

…then it’s no surprise that as an adult, you may feel guilty about success or sabotage your own progress.

The good news? You’re not doomed to repeat those patterns. Becoming aware of them is the first step.

2. Emotional Baggage

Money is emotional. Fear, shame, guilt, anxiety—all of these can cloud our decisions. We avoid checking bank balances. We overspend to feel better. We undercharge for our services because we don’t feel worthy.

To create wealth, you must deal with your emotions without letting them drive the car.

3. Self-Limiting Beliefs

The most dangerous beliefs are the ones we don’t question.

If you’ve ever said, “I’m just not a numbers person,” ask yourself, who told you that? And is it true?

Every wealthy person you admire had to learn how money works. You can too. Beliefs are not facts. They are scripts, and you can rewrite your script.

How to Build a Resilient, Growth-Oriented Wealth Mindset

1. Practice Awareness

Start noticing your internal dialogue around money. Write down:

- What were the first money lessons you ever learned?

- What do you say to yourself after you make a financial mistake?

- What emotions come up when you talk about income, debt, or savings?

Awareness creates space. And space allows for choice.

2. Use Affirmations Grounded in Action

Not the fluffy kind like “I’m a money magnet” — but affirmations that inspire change:

- “I take full responsibility for my financial future.”

- “I make choices that align with my long-term goals.”

- “I am worthy of wealth, and I work toward it daily.”

Repeat them, but also act on them. Consistency is where the magic happens.

3. Cultivate Mental Resilience

Resilience is your ability to bounce back after setbacks. In your financial journey, you will make mistakes. You might lose money. A business might fail. An investment might not return.

Resilient wealth builders:

- Learn from the experience

- Adjust their strategy

- Stay committed

Instead of asking “Why me?” ask “What can I learn from this?”

4. Upgrade Your Financial Literacy

A strong mindset is not just emotional—it’s practical.

- Read one finance book every 3 months.

- Subscribe to personal finance newsletters.

- Take a free online course on budgeting, investing, or business.

The more you understand money, the less you’ll fear it—and the more confidence you’ll build.

5. Surround Yourself with Financially Empowered People

Your environment matters. If your friends are always broke, stressed, or complaining about money, it affects you more than you think.

That doesn’t mean you need to abandon people. But you do need to diversify your influences:

- Join financial accountability groups.

- Follow creators who teach sound money principles.

- Find mentors who live the life you aspire to.

Proximity is power. Get close to people who think bigger.

Daily Practices to Strengthen Your Wealth Mindset

- Morning Gratitude: Write 3 things you’re financially grateful for.

- Track Your Spending: Awareness leads to control.

- Weekly Money Check-In: Review goals, wins, and setbacks.

- Visualization: Spend 5 minutes visualizing your abundant future.

- Learn Something New: Read or watch one short financial lesson daily.

A Wealth Mindset Doesn’t Mean Toxic Positivity

Some people misunderstand mindset work as pretending everything is fine.

But a true abundance mindset is about honoring reality while focusing on possibility. It’s not pretending your account isn’t low—it’s reminding yourself you can change that.

It’s not ignoring inflation or job loss—it’s preparing for those things in advance.

It’s not about blaming yourself—it’s about empowering yourself.

Chapter Summary

- Your mindset forms the foundation of your financial life.

- Limiting beliefs, emotional habits, and social conditioning can keep you stuck.

- With awareness, repetition, and learning, you can build a mindset that attracts—not repels—wealth.

- Financial resilience is emotional as much as it is logical.

- The right mindset makes every strategy in this book 10x more powerful.

Chapter 3: Modern Wealth-Building Principles

The Blueprint for Sustainable Financial Growth

Once your mindset is aligned with wealth and abundance, it’s time to put that mindset into motion.

In the modern financial landscape, building wealth isn’t about guessing the next big stock or getting lucky with crypto. It’s about developing a system of smart, sustainable financial behaviors that compound over time—across income, savings, debt, and investment.

Let’s break down the core principles that form the architecture of modern wealth-building in 2025 and beyond.

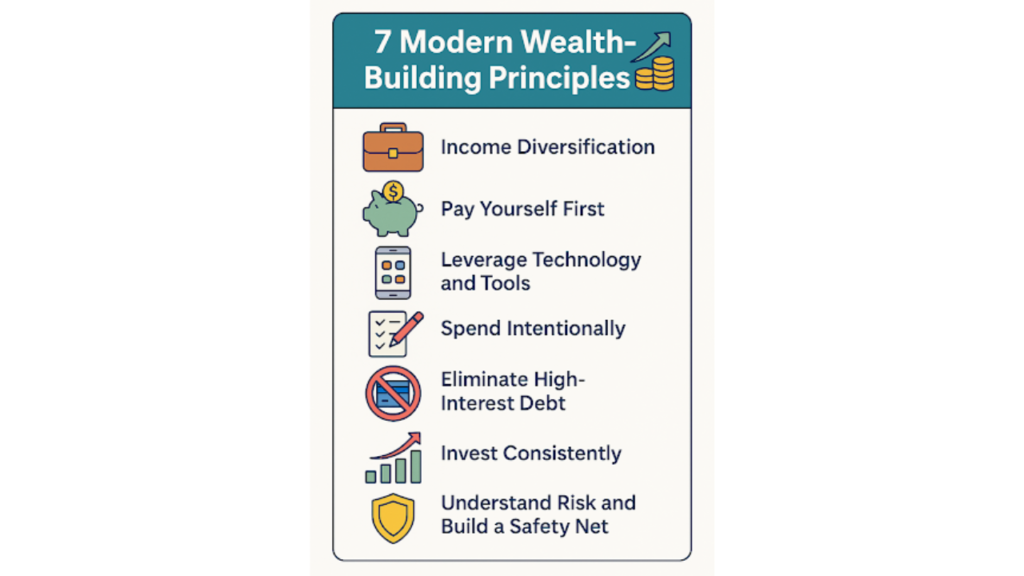

Principle 1: Income Diversification

“Never depend on a single income. Make investments to create a second source.”

— Warren Buffett

Most people rely solely on their job to provide income. That’s risky. Layoffs, burnout, automation, and economic shifts can wipe that source out overnight.

Today’s wealth builders treat income like a portfolio.

The Three-Legged Stool of Income:

- Active Income — Your job, freelance work, or service-based business.

- Semi-Passive Income — A side hustle, online store, or consulting gig.

- Passive Income — Dividends, royalties, digital products, real estate income

Example:

Jasmine is a full-time copywriter. She also runs a $40/month subscription newsletter and earns affiliate income through her YouTube channel. None of it is accidental—she’s built streams that align with her skills and time.

Action Step:

List your current income sources and brainstorm 2 additional ones that would complement your skills and interests.

Principle 2: Pay Yourself First

This principle is simple but powerful: before you spend on anything else, allocate money to your future self.

Whether it’s $50 or $500 per paycheck, automate the habit of:

- Transferring funds to a savings account

- Contributing to your retirement account (401k, IRA)

- Investing into a diversified portfolio

Why? Because humans have a natural tendency to spend whatever is left. If you flip the script and save first, you force abundance.

Action Step:

Set up an automatic transfer to savings/investment as soon as your paycheck hits.

Principle 3: Leverage Technology and Tools

We live in a time when managing money no longer requires spreadsheets or a degree in finance.

Here are some of the best tech tools for building wealth:

| Category | Tools/Apps |

| Budgeting | YNAB, Monarch Money, Mint |

| Investing | Vanguard, Fidelity, M1 Finance |

| Robo-Advisors | Betterment, Wealthfront |

| Net Worth Tracking | Personal Capital, Kubera |

| Habit Building | Notion, Tiller, Habitica |

Modern tools give you clarity and consistency. The fewer decisions you leave to chance, the more likely you’ll build wealth.

Action Step:

Pick one financial app this week and set it up to track your spending or net worth.

Principle 4: Spend Intentionally, Not Emotionally

Wealthy people don’t necessarily spend less—they just spend deliberately.

They align spending with their values:

- They buy less “stuff” but more experiences.

- They value quality over quantity.

- They avoid emotional spending as a coping mechanism.

“Don’t tell me what you value. Show me your budget, and I’ll tell you what you value.”

— Joe Biden

Action Step:

Audit your last month’s expenses. Ask yourself: “Was this aligned with my goals, or was it a distraction?”

Principle 5: Eliminate High-Interest Debt Fast

If you’re paying 20% interest on a credit card, it doesn’t matter how great your investments are—you’re falling behind.

Prioritize:

- Credit cards

- Personal loans

- Buy-now-pay-later schemes

Think of high-interest debt as a tax on your future freedom.

Action Step:

Use either the snowball method (smallest balances first) or avalanche method (highest interest first) to pay off bad debt aggressively.

Principle 6: Invest Consistently (Not Emotionally)

Investing should feel boring.

Why? Because boring is repeatable. Chasing hype, timing markets, or betting on meme coins might sound exciting—but long-term wealth comes from simple, disciplined investing.

What works in 2025:

- Index funds & ETFs (S&P 500, Total Market)

- Dollar-cost averaging (investing the same amount monthly)

- Tax-advantaged accounts (401k, IRA, HSA)

Example:

Alex invests $300/month into a low-cost ETF starting at age 25. By 55, with an average 8% return, he could have over $400,000—even if he never increases his contribution.

Action Step:

Open a brokerage or retirement account this week. Start with as little as $50.

Principle 7: Understand Risk and Build a Safety Net

Don’t skip this one. Even the best-laid wealth plans fall apart without risk management.

You need:

- Emergency fund (3–6 months of expenses)

- Insurance (health, life, renters/homeowners)

- Income backup (side hustle or bridge skills)

When you plan for the worst, you’re free to pursue the best with confidence.

Action Step:

Audit your emergency fund. Do you have at least one month of expenses saved? If not, make this your next financial goal.

Recap: The 7 Modern Wealth Principles

| Principle | Purpose |

| Income Diversification | Builds resilience |

| Pay Yourself First | Forces savings and investing discipline |

| Leverage Financial Technology | Makes tracking and automation simple |

| Spend Intentionally | Aligns money with values |

| Eliminate High-Interest Debt | Stops wealth leaks |

| Invest Consistently | Grows long-term financial assets |

| Manage Risk | Protects against setbacks |

Final Thoughts: Systems > Willpower

If you take nothing else from this chapter, remember this:

Wealth isn’t built on motivation. It’s built on systems.

Motivation fades. Willpower fails. But systems—automated transfers, scheduled reviews, structured investment plans—keep working whether you feel inspired or not.

Design your financial environment to support your goals. Make it harder to fail and easier to win.

Chapter 4: Investing in 2025 and Beyond

How to Grow Wealth in a Rapidly Changing World

Investing Is No Longer Optional

We’ve entered an age where relying solely on savings is no longer sufficient. In the past, you could put your money in a savings account and earn 5% interest while inflation was 2%. Today, inflation often outpaces the interest you earn, which means that saving alone can actually decrease your purchasing power.

So if you want your money to grow—and eventually work for you—investing is a necessity. But don’t worry: it’s not as complicated or risky as it’s often made out to be. With the right mindset, consistent habits, and a bit of patience, investing becomes one of your most powerful tools for creating lasting financial abundance.

What Does “Investing” Actually Mean?

Investing means putting your money into assets—things of value—that are expected to grow over time. These could be stocks, real estate, mutual funds, a business, or even digital assets.

Unlike saving, which prioritizes safety and liquidity, investing is focused on growth and long-term gain. It’s the difference between parking your money and sending it out to build more wealth on your behalf.

Why Most People Avoid It (and Why You Shouldn’t)

The most common reasons people avoid investing are:

- “I don’t understand it.”

- “I’m afraid of losing money.”

- “I don’t have enough to start.”

- “I’ll wait until I’m making more.”

These are all understandable concerns. But here’s the truth:

- You don’t need to be a finance expert.

- You don’t need thousands of dollars.

- You don’t need to be fearless.

- You just need to start small and stay consistent.

Investing Is a Habit, Not a One-Time Event

The key to successful investing is consistency—not brilliance.

Forget chasing stock tips or gambling on Bitcoin because someone on Twitter promised it would “moon.” Instead, think like a long-term investor: measured, methodical, and future-focused.

“Someone is sitting in the shade today because someone planted a tree a long time ago.”

— Warren Buffett

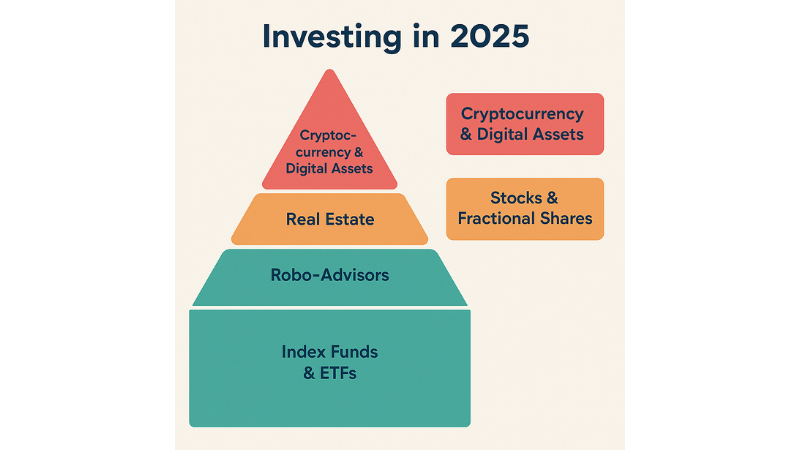

Your Investment Toolbox: What to Know in 2025

Now let’s walk through the most relevant investment options available in 2025, including their strengths, risks, and use cases. You’ll see that there’s something here for everyone.

Index Funds & ETFs: The Foundation of Modern Investing

What they are:

Index funds and ETFs (exchange-traded funds) are collections of stocks bundled together to mimic a specific part of the market. The S&P 500, for instance, is an index fund that includes 500 of America’s largest companies.

Why it works:

- Instant diversification (you’re not betting on one company)

- Low fees

- Proven long-term growth

- Can start with $10–$100

Ideal for:

First-time investors and people who want a “set-it-and-forget-it” portfolio.

Example:

Instead of choosing between Apple, Amazon, and Google, you invest in an ETF that includes all three—and hundreds more.

Robo-Advisors: Automated Investing for Busy People

What they are:

Robo-advisors are AI-powered platforms that build and manage your investment portfolio automatically. You answer a few questions about your goals and risk tolerance, and the software does the rest.

Why it works:

- Completely hands-off

- Rebalances your portfolio automatically

- Tax-loss harvesting for efficiency

Ideal for:

Professionals who want wealth growth without learning investing mechanics.

Popular platforms:

Betterment, Wealthfront, Ellevest

Stocks & Fractional Shares: Direct Ownership in Companies

What they are:

When you buy a stock, you own a piece of a company. Today, you can buy fractional shares, so instead of needing $3,000 to invest in a full Amazon share, you can buy $10 worth.

Why it works:

- Potential for higher returns

- Allows you to invest in companies you believe in

- Easy to access through apps like Robinhood, SoFi, and Public

Risks:

- Requires research

- Can be volatile short-term

Tip:

Avoid turning stock investing into day trading. The market rewards patience more than excitement.

Real Estate: Physical or Digital Property with Lasting Value

What it is:

Investing in property—either directly (buying a house or apartment) or indirectly (through REITs or crowdfunding).

Why it works:

- Generates passive income through rent

- Increases in value over time

- Real estate often rises with inflation

Modern methods:

- Crowdfunding platforms like Fundrise and Arrived Homes

- REITs (real estate investment trusts) traded on stock exchanges

- Digital real estate (tokenized assets and metaverse plots—more speculative)

Downsides:

- Higher entry cost (though less now with crowdfunding)

- Management required (for direct ownership)

Cryptocurrency & Digital Assets: The New Frontier

What they are:

Digital currencies like Bitcoin, Ethereum, and emerging assets like NFTs and DeFi tokens.

Why it’s appealing:

- Massive growth potential

- New use cases (smart contracts, DeFi platforms, blockchain applications)

Caution:

- Volatile and unregulated

- Subject to scams, hacks, and speculation

Best practice:

- Only invest what you can afford to lose

- Limit to 1–5% of your total portfolio

- Use cold wallets for security

ESG & Impact Investing: Grow Your Money with Your Values

What it is:

Investing in companies that prioritize Environmental, Social, and Governance (ESG) criteria. Examples include green energy, ethical labor, and gender diversity.

Why it matters:

You don’t have to choose between profit and principles.

Top ESG Funds:

- iShares ESG Aware

- Vanguard FTSE Social Index

- SPDR Gender Diversity Index

Ideal for:

Those who want to create financial AND social impact.

How Much Should You Invest?

Start with what you can—even if it’s just $20/month. Over time, aim for:

- 10–15% of your monthly income

- Allocate across safe (index funds), moderate (real estate/ESG), and speculative (crypto)

The earlier you start, the more time compound interest has to work its magic.

Creating a Simple Portfolio Example

Beginner Portfolio: $300/month

- $150 in a diversified S&P 500 index fund (low-cost, long-term growth)

- $75 in a robo-advisor account (automated diversification)

- $50 in real estate crowdfunding (passive income growth)

- $25 in crypto or tech stocks (speculative exposure)

Rebalance once a year, and increase contributions as your income grows.

Investing Isn’t About Luck — It’s About Time

The longer your money stays invested, the more powerful it becomes. This is due to compounding—where your gains earn more gains.

Example:

- Invest $200/month from age 25 to 55 = over $225,000+

- Wait until age 35? That drops to around $115,000

Start now. Even small amounts will grow.

Final Thoughts

Investing used to be intimidating. Today, it’s accessible, automated, and essential.

You don’t have to be perfect. You just have to be consistent.

You don’t have to pick the next Tesla. You just have to pick a plan and stick with it.

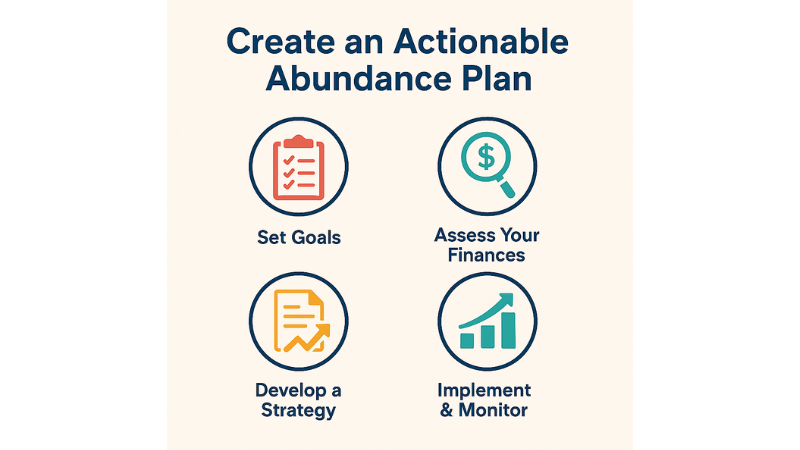

Chapter 5: Create an Actionable Abundance Plan

How to Design a Personal Roadmap to Financial Freedom

From Knowing to Doing

By this point in the book, you understand the new definition of wealth, how mindset shapes behavior, and the principles behind earning and investing smartly.

But knowledge without action is just potential. The purpose of this chapter is to help you bridge the gap between information and execution—to design a system that works for you, starting right now.

This isn’t about perfection. It’s about getting organized, getting started, and committing to consistency.

The Foundation: Know Your Numbers

Before you can build an abundance plan, you need a clear view of your current financial reality.

Start with these basic components:

1. Income

- What are your current income sources? List all of them: job, side hustle, freelancing, rent, dividends, etc.

- What’s your total monthly income after taxes?

2. Expenses

- Track your last 30–90 days of spending. Use an app (like YNAB, Mint, Monarch) or a spreadsheet.

- Break it down by category: housing, food, transportation, debt payments, subscriptions, etc.

3. Net Worth

- Net worth = Assets – Liabilities

- Assets: cash, investments, property, savings

- Liabilities: credit card debt, loans, mortgages

This isn’t to judge yourself—it’s to give you the map. You can’t get to where you want to go if you don’t know where you’re starting from.

Step 1: Set Your Vision for Abundance

You’re not just planning money—you’re planning your life.

Ask yourself:

- What does abundance look like for me?

- How much do I want in emergency savings?

- How much do I want to earn monthly?

- What kind of work/lifestyle do I want?

- Do I want to retire early? Travel? Own property?

Write your answers down. Make them tangible.

“Clarity is the catalyst of change.”

Step 2: Establish SMART Financial Goals

Once you have your vision, break it into S.M.A.R.T. goals (Specific, Measurable, Achievable, Relevant, Time-bound).

Examples:

- “Save $5,000 for emergencies within 12 months.”

- “Invest $300/month into index funds for the next 5 years.”

- “Pay off $10,000 of credit card debt by December next year.”

Goals turn hope into structure.

Step 3: Build Your Monthly Financial System

This is the engine room of your abundance plan. Here’s a simple but powerful structure:

AUTOMATE INCOME FLOW

Set your direct deposit to flow into one of three buckets:

- Needs (50%) – rent, bills, groceries, transportation

- Goals (30%) – savings, investing, debt payoff

- Wants (20%) – dining, travel, subscriptions

Use automatic transfers to:

- Pay yourself first (into savings/investments)

- Pay recurring bills

- Route funds to a “fun” account

Automation is what turns discipline into default behavior.

Step 4: Create Your Emergency Safety Net

Financial security starts here. Build an emergency fund of at least 3–6 months of core living expenses.

Start with a $1,000 mini-fund if you’re in debt, then grow from there.

Keep this fund in a high-yield savings account (not checking or investing—it needs to be liquid and safe).

Step 5: Eliminate Toxic Debt

Toxic debt = anything with high interest that doesn’t build wealth.

Examples:

- Credit cards (15–30% interest)

- Payday loans

- Buy-now-pay-later schemes

Use either:

- Avalanche Method (pay highest interest first)

- Snowball Method (pay smallest balance first for momentum)

Pair it with small celebration milestones for motivation.

“Every dollar you send to credit card interest is a dollar not working for your future.”

Step 6: Build an Investment Stack

Once your emergency fund and debt payoff are underway, start investing with a plan.

Here’s a simple tiered approach:

- 401(k) match – Contribute enough to get full employer match (it’s free money)

- Roth IRA – Tax-free growth and withdrawal in retirement

- Taxable Brokerage – Use for flexible investing outside of retirement

Target 10–15% of your income, even if it starts small.

Step 7: Add Income Streams

Now that your financial base is stable, start designing diversified income. Some ideas:

- Sell digital products (eBooks, templates, courses)

- Freelance (writing, design, consulting)

- Start a niche YouTube or newsletter

- Rent a room on Airbnb

- Invest in dividend-paying stocks

You don’t need all of these. You just need one to start.

“One extra $500/month may change your entire timeline to financial freedom.”

Step 8: Plan Quarterly Financial Reviews

Systems decay if they’re not maintained. So set a money date with yourself every 3 months.

Review:

- Net worth changes

- Spending trends

- Goal progress

- Automation settings

- Investment performance

Adjust. Realign. Celebrate growth.

Chapter Summary: Your Abundance Plan in Action

| Step | Action | Outcome |

| 1 | Define your vision | Clarity on what wealth means to you |

| 2 | Set SMART goals | Turn desires into structure |

| 3 | Automate your system | Reduce stress and human error |

| 4 | Build emergency fund | Gain security and peace of mind |

| 5 | Pay off bad debt | Eliminate what holds you back |

| 6 | Start investing | Grow wealth with time and consistency |

| 7 | Diversify income | Build resilience and scalability |

| 8 | Review quarterly | Stay aligned, adaptive, and empowered |

You Don’t Need to Be Perfect—You Just Need to Be Persistent

Most people never build a plan. They drift through their financial life hoping things will work out.

But abundance isn’t accidental. It’s built.

Your plan will evolve. You’ll stumble at times. But with a clear structure, honest reflection, and consistent action, you’re already ahead of 90% of the population.

This is your financial blueprint.

Chapter 6: Tools for Wealth Management

Your Digital Financial Toolkit for 2025

Why Tools Matter

Systems build wealth—but tools build systems.

Trying to manage your finances without tools in 2025 is like trying to navigate a city without GPS. Sure, you can do it with a map and a compass, but it’s slower, messier, and far more stressful.

Thankfully, we live in an era of intuitive, powerful, and often free or low-cost financial tools. These apps and platforms can help you:

- Track spending

- Monitor net worth

- Automate investing

- Plan for goals

- Build habits

- Stay accountable

In this chapter, we’ll break down the top tools by category—so you can create a personalized, tech-powered wealth management system.

1. Budgeting & Expense Tracking

Budgeting is the foundation of any abundance plan. It helps you take control of your money before it controls you.

Top Tools:

| Tool | Why It’s Great |

| YNAB (You Need A Budget) | Best for proactive planning, zero-based budgeting, and goal tracking |

| Monarch Money | Clean, collaborative, great for couples/families |

| Mint (being phased out by Intuit) | Once popular, but support is dwindling |

| Tiller | Spreadsheet-based but auto-updated from bank feeds |

| EveryDollar | Simple, Dave Ramsey-endorsed envelope method |

Best Practice: Budgeting isn’t restriction—it’s intentionality. A budget is permission to spend on what matters most.

2. Net Worth and Wealth Tracking

Tracking your net worth over time is one of the most motivating financial habits. You can see your actual progress—even when your income doesn’t change.

Top Tools:

| Tool | Key Features |

| Empower (formerly Personal Capital) | Links all accounts, visualizes investments, free retirement planner |

| Kubera | Sleek, secure, supports global assets and crypto |

| Notion or Airtable | Manual but fully customizable for power users |

Start simple: Assets – Liabilities = Net Worth. Track this monthly or quarterly.

3. Investing & Portfolio Management

Whether you’re new to investing or already growing a portfolio, these platforms help automate the process.

Top Tools:

| Tool | Ideal For |

| Vanguard / Fidelity / Schwab | Long-term index fund investing, trusted institutions |

| M1 Finance | Build custom investment “pies” with auto-balancing |

| Betterment / Wealthfront | Robo-advisors that manage everything for you |

| Public / Robinhood / SoFi | Easy access to stocks, ETFs, crypto (caution: use for long-term, not day trading) |

Automate monthly contributions. Even small amounts compound powerfully.

4. Debt Payoff & Credit Monitoring

To escape the debt cycle, you need visibility and control. These tools help you monitor credit health and create repayment plans.

Top Tools:

| Tool | Purpose |

| Credit Karma | Free credit monitoring, scores, and simulators |

| Experian Boost | Adds utility/phone payments to your credit report |

| Undebt.it | Create custom debt payoff strategies |

| Tally | Debt manager app that helps pay down credit cards automatically |

Knowing your credit score is like knowing your financial reputation. Monitor it monthly.

5. Planning & Habits

It’s not just about numbers—it’s about behaviors. These tools help you build routines, reflect on goals, and stay mentally aligned with your financial journey.

Top Tools:

| Tool | Use Case |

| Notion | Personal dashboards, habit tracking, goal journaling |

| Evernote | Capture ideas, reflections, and planning notes |

| Streaks / Habitica / TickTick | Habit-building and consistency gamification |

| Google Calendar | Schedule monthly finance check-ins or reviews |

Wealth isn’t just built with money—it’s built with mindset + habits.

Building Your Custom Stack

Here’s a sample “starter stack” if you’re new to financial systems:

| Category | Tool |

| Budgeting | YNAB |

| Net Worth | Empower |

| Investing | Betterment + Roth IRA at Vanguard |

| Credit Tracking | Credit Karma |

| Habits | Notion weekly planner |

And if you’re more advanced:

| Category | Tool |

| Budgeting | Monarch or Tiller |

| Investing | M1 Finance + Fundrise + Fidelity brokerage |

| Net Worth | Kubera |

| Debt | Undebt.it |

| Planning | Notion with goal + financial review templates |

Chapter Summary: Digitize to Optimize

Tools don’t replace effort—but they make it frictionless.

You don’t need to use every platform listed. Pick a few that align with your style—visual, spreadsheet-based, automated, manual—and let them work with you.

The point isn’t to make your financial life more complicated. It’s to make it more efficient, visible, and consistent.

“Your phone can either be a distraction from your wealth—or the dashboard that helps you build it.”

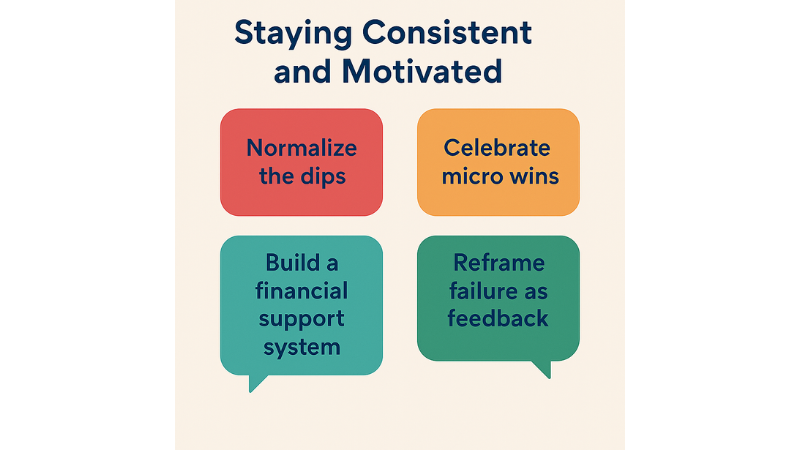

Chapter 7: Staying Consistent and Motivated

How to Stay on Track When Life Gets Busy, Boring, or Hard

The Real Challenge: Not Starting, But Sustaining

If you’ve made it this far, you already know something critical:

Wealth isn’t built in a week—it’s built in cycles.

Everyone feels excited at the beginning. You download the apps, create your budget, open your investing account—and then… life happens. A stressful month. A surprise expense. A moment of burnout. Suddenly, the system breaks, and you’re back where you started.

This chapter is about how to keep going—especially when it’s no longer new, or easy, or exciting.

Why Most People Fall Off the Wealth Journey

Here are the most common reasons people abandon their financial plans:

- Lack of visible progress – “I’ve been saving/investing for 3 months and nothing’s changed.”

- Lifestyle pressure – Friends are traveling, upgrading, or spending freely.

- Burnout from budgeting – It feels restrictive instead of empowering.

- Emotional triggers – Anxiety, guilt, shame, or discouragement lead to avoidance.

- Perfectionism – One mistake feels like failure, so people quit altogether.

The antidote to all of these is consistency—not perfection.

The Psychology of Consistency

Consistency isn’t about being highly motivated all the time. It’s about building systems and rhythms that work even when motivation disappears.

Let’s break down the core principles:

1. Systems Beat Willpower

You will forget. You will get busy. You will be tired. That’s human.

That’s why automation is your ally.

Examples:

- Automatic transfers to savings/investments

- Scheduled budget check-ins on your calendar

- Subscriptions you’ve already “baked in” to your spending plan

Remove the need for constant decision-making. The fewer financial decisions you leave to chance, the more consistently you’ll build wealth.

2. Normalize the Dips

Your finances will have seasons:

- Momentum phases – Income grows, investments perform, goals are hit.

- Plateau phases – Things feel static, even boring.

- Crisis phases – Unexpected costs, setbacks, mistakes.

These are not signs of failure. They are signs that you’re on a real journey.

“Long-term consistency beats short-term intensity.”

— Bruce Lee

What matters is that you return to the system. Always.

3. Celebrate Micro Wins

Your brain needs rewards. Most financial progress is invisible for a while. That’s why you must create micro-milestones to stay energized.

Examples:

- Hit a $1,000 savings goal? Celebrate with a fancy homemade dinner.

- Paid off a credit card? Share the win with a trusted friend.

- Automated your Roth IRA? Screenshot it and track your streak.

The small wins are the big wins—because they keep you going.

4. Build a Financial Support System

Wealth is personal—but it doesn’t have to be lonely.

People stay consistent when they’re surrounded by:

- Accountability partners (friends, spouse, mentor)

- Positive financial content (books, podcasts, creators)

- Community (Reddit forums, FB groups, local meetups)

Guard your inputs. Unfollow the people who make you feel “behind.” Follow people who remind you of what’s possible.

“You become who you surround yourself with—digitally and in person.”

5. Reframe Failure as Feedback

You will:

- Miss a budget goal

- Forget a bill

- Overspend on something impulsive

- Watch an investment drop

This isn’t failure. This is data.

Instead of guilt or avoidance, ask:

- What triggered this?

- How can I adjust the system?

- What support or tool might help next time?

Resilient wealth builders bounce forward.

Daily, Weekly, Monthly Wealth Habits

Let’s make this real and structured.

Daily (5–10 minutes)

- Log spending or review transactions

- Say or journal one financial affirmation

- Skim a money tip or finance tweet/newsletter

Weekly (15–30 minutes)

- Review budget/spending

- Transfer to savings or investments

- Review short-term goals

- Prep for major expenses (holidays, travel, bills)

Monthly (30–60 minutes)

- Update net worth

- Review debt progress

- Revisit your SMART goals

- Reflect on wins, struggles, and adjustments

Build a Ritual That Works for You

Consistency thrives when it’s attached to rhythm.

Examples:

- Sunday mornings = “Wealth Check” with coffee and your dashboard

- Friday nights = Quick money review before Netflix

- 1st of the month = Portfolio rebalancing and donation

You don’t need the perfect system. You just need one you’ll actually do.

What to Do When You Feel Stuck

It happens to everyone. Here’s what helps:

- Reset your why: Reconnect with the purpose behind your plan (freedom, security, legacy).

- Zoom out: Look at your last 6–12 months. Often, progress feels invisible up close.

- Simplify: Remove tools or steps you’re not using. Go back to the basics.

- Ask for help: You don’t have to do it alone.

Chapter Summary: Stay In the Game

| Concept | Reminder |

| Perfection isn’t required | Persistence is more powerful |

| Systems > Willpower | Automate everything you can |

| Small wins matter | Track and reward them |

| Setbacks are part of the process | Reframe, don’t retreat |

| Accountability helps | Build your financial ecosystem |

You don’t win at wealth by being perfect.

You win by staying in the game longer than most people are willing to.

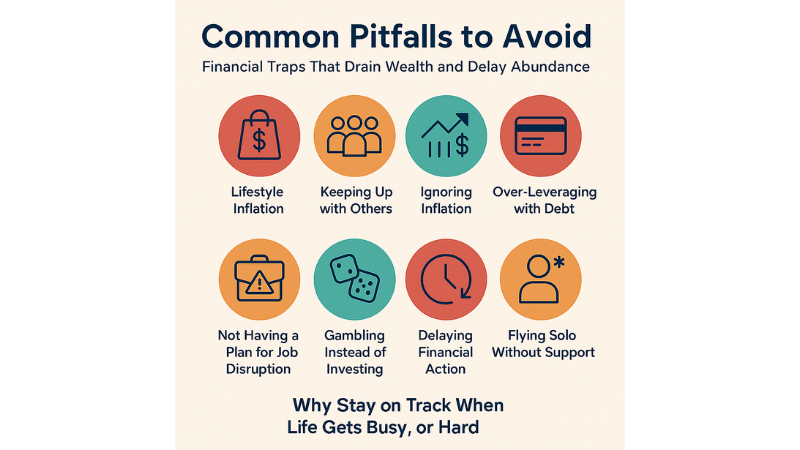

Chapter 8: Common Pitfalls to Avoid

Financial Traps That Drain Wealth and Delay Abundance

Why This Chapter Matters

You can do 90% of things right—but a few wrong moves can sabotage years of progress.

This chapter is here to act as your radar. Because in wealth-building, it’s not just about making good decisions—it’s also about avoiding costly mistakes.

Think of it as a personal financial early-warning system. Let’s cover the major dangers—and how to dodge them like a pro.

Pitfall 1: Lifestyle Inflation

What it is:

As income increases, so does spending. Promotions, bonuses, or new streams of income become excuses to upgrade everything—housing, car, wardrobe, vacations.

Why it’s dangerous:

Your expenses grow at the same pace as (or faster than) your income, which means no real progress in savings or investments.

How to avoid it:

- Treat income boosts as opportunities to boost savings/investing first, then spending.

- Give yourself a “lifestyle raise” of 10–20%, and invest the rest.

- Pause before upgrading: Is this aligned with my actual values—or just habits and comparison?

“Just because you can afford something doesn’t mean you should finance it with your future.”

Pitfall 2: Keeping Up with Others

What it is:

Spending money to match the perceived lifestyle of friends, coworkers, influencers, or neighbors—often subconsciously.

Why it’s dangerous:

You end up measuring your insides against someone else’s outside. Social media makes it worse: people post highlights, not bank statements.

How to avoid it:

- Get brutally honest about your goals and priorities.

- Curate your feed—follow those who inspire frugality, strategy, or values-driven living.

- Ask: “Would I still want this if no one else saw it?”

Pitfall 3: Ignoring Inflation

What it is:

Assuming that saving $10,000 today will mean the same in 10 years.

Why it’s dangerous:

Prices go up. The same $100 buys you less over time. Keeping large amounts of cash uninvested means your wealth loses value silently.

How to avoid it:

- Keep only your emergency fund in savings.

- Invest for long-term goals to beat inflation.

- Review your budget yearly to adjust for cost-of-living changes.

Pitfall 4: Over-Leveraging with Debt

What it is:

Using credit cards, BNPL apps, or loans to fund a lifestyle—or stretching to buy a home/car at the edge of affordability.

Why it’s dangerous:

Debt multiplies risk. If income drops, interest still grows. In downturns or emergencies, over-leverage can collapse your whole financial plan.

How to avoid it:

- Know your debt-to-income ratio (DTI) and keep it low.

- Don’t confuse “approved” with “affordable.”

- Use debt only when it builds assets (e.g., strategic real estate or business investments).

Pitfall 5: Not Having a Plan for Job Disruption

What it is:

Assuming your income will be stable forever—while industries, technologies, and markets evolve.

Why it’s dangerous:

Layoffs, AI disruption, or burnout can happen fast. Without a plan, it leads to panic, emergency borrowing, or derailed goals.

How to avoid it:

- Build a 3–6 month emergency fund.

- Cultivate marketable skills—always be learning.

- Diversify income streams proactively, not reactively.

Pitfall 6: Gambling Instead of Investing

What it is:

Confusing investing with speculation—putting large amounts into meme stocks, random cryptos, or “get rich quick” plays based on hype.

Why it’s dangerous:

No research, no strategy, no risk management = high odds of loss.

How to avoid it:

- Invest with a plan. Speculate with “fun money” only.

- Diversify. Avoid all-in bets.

- If you can’t explain the asset to a 10-year-old, you shouldn’t buy it.

Pitfall 7: Delaying Financial Action

What it is:

Procrastinating on starting a budget, opening an investment account, or paying down debt—waiting for “more time,” “more income,” or “the right moment.”

Why it’s dangerous:

Time is your most powerful asset. The longer you wait, the more opportunity you lose.

How to avoid it:

- Start small. Start messy. But start now.

- Set a timer for 20 minutes and complete one task: open a savings account, set up auto-transfer, etc.

- Focus on progress, not perfection.

Pitfall 8: Flying Solo Without Support

What it is:

Trying to manage your entire financial life alone—without accountability, mentorship, or community.

Why it’s dangerous:

You miss out on perspective, encouragement, and strategy from others who’ve already been through it.

How to avoid it:

- Talk to friends about money (those who are supportive and nonjudgmental).

- Join an online group (like r/personalfinance or Bogleheads).

- Consider a financial coach or planner if you’re stuck or scaling.

How to Recover If You’ve Made These Mistakes

Everyone falls into at least one of these traps at some point. The goal isn’t to avoid them forever—it’s to recognize them early, course-correct quickly, and grow wiser each time.

If you’re in a financial hole:

- Pause the panic.

- Assess the damage honestly.

- Choose one simple, positive action: consolidate debt, cancel a subscription, automate a $10 investment.

Then build from there.

“Every wealth journey has a plot twist. What matters is that you keep writing the story.”

Chapter Summary: Pitfalls Are Part of the Path

| Pitfall | Remedy |

| Lifestyle inflation | Save/invest before upgrading |

| Keeping up with others | Follow your own metrics |

| Ignoring inflation | Invest early and regularly |

| Over-leveraging | Only use debt that builds |

| Job disruption | Prepare with skills and savings |

| Gambling vs. investing | Use strategy and diversify |

| Procrastination | Take imperfect action now |

| Isolation | Build a financial support circle |

Chapter 9: The Future of Financial Abundance

How to Thrive in a Fast-Changing World

Wealth in a World That Won’t Slow Down

The rules of money are changing. Fast.

In the last decade, we’ve seen:

- The rise (and crash) of cryptocurrencies

- AI disrupting industries in real time

- Remote work going mainstream

- Entire careers born from social media, gaming, and the creator economy

- Inflation returning as a global concern

- People reassessing the very meaning of work, income, and wealth

This isn’t just noise—it’s a signal: You must build financial abundance for a future that will look very different from the past.

What Financial Abundance Will Look Like in the 2030s

The next chapter of financial freedom won’t be about simply having more money—it’ll be about having more:

- Adaptability – The ability to pivot as industries, currencies, and economies shift

- Tech fluency – Using tools like AI, blockchain, and automation to earn, manage, and invest smarter

- Emotional intelligence – Making decisions not based on fear or greed, but clarity and long-term vision

- Skill diversity – Earning from multiple platforms, crafts, or ideas—not one employer

We’re moving toward a future where flexibility = financial power.

Emerging Trends That Will Shape Wealth-Building

Let’s explore what’s rising—and what it means for you.

1. The Rise of AI-Driven Earning

- Freelancers are automating content, code, designs, and more using GPT, Midjourney, etc.

- Businesses will seek “AI-augmented humans” who can work faster and smarter

- Expect new income streams powered by tools—not time

Abundance comes not from working harder—but from leveraging smarter tools.

2. The Decentralization of Finance

- Traditional banks are being challenged by DeFi platforms and digital wallets

- Crypto assets are evolving beyond speculation into utilities (smart contracts, global remittances)

- Tokenized real estate and digital ownership models are emerging

You don’t have to be a blockchain expert—but you do need to understand the basics of decentralized systems.

3. The Creator-Entrepreneur Explosion

- More people are making money from newsletters, TikToks, niche YouTube channels, courses, and communities

- Platforms are offering creators ownership (e.g. ad revenue, tipping, NFTs)

You don’t need millions of followers—1,000 true fans can fund a full-time income if you create real value.

Future abundance favors the micro-entrepreneur with a message.

4. Location-Independent Living

- Remote work = more people living where costs are low and quality of life is high

- Geo-arbitrage strategies let people earn in dollars, live in pesos/euros/baht

- Digital nomad visas and international income planning are on the rise

Abundance = freedom to choose your geography with intention.

5. The Shift from Consumption to Sustainability

- Gen Z and Millennials are spending more on experiences, education, and values, less on status

- Investing in ESG (Environmental, Social, Governance) portfolios is becoming mainstream

- Minimalism and digital detoxes are countering overconsumption

Future wealth is less about what you own—and more about what you’re free from.

Your Role in the Future: Be the Builder

Here’s the best part: You are not a spectator in this evolution—you’re a participant.

The same tools that billionaires use to grow their wealth are in your hands:

- You can buy fractional shares of global companies

- You can build a brand with nothing but a phone

- You can learn any skill on YouTube or Coursera

- You can invest automatically for $5/month

- You can launch a business in a weekend

The barriers to wealth have never been lower—but the noise and distractions have never been louder.

Principles That Will Always Matter (Even in the Future)

Amid all the change, some truths stay timeless:

| Principle | Future Proof Value |

| Compound Interest | Still the most powerful financial force |

| Emotional Discipline | Always trumps hype and panic |

| Ownership > Employment | Build equity, not just earn wages |

| Clarity of Vision | Your financial path = your life design |

| Giving Generously | True abundance includes lifting others |

Design a Life of Abundance—Not Just a Bank Account

In the end, financial abundance is about creating a life that feels rich—not just financially, but mentally, emotionally, and spiritually.

It’s the freedom to:

- Spend time how you want

- Live where you choose

- Say no without fear

- Help others without hesitation

- Wake up excited—not anxious—about the future

That’s the new wealth.

And you’re already building it.

Final Words: Start Now. Start Simple. Stay Consistent.

You’ve just finished reading a blueprint—a living guide to financial abundance. But its value only comes when you act on it.

So start where you are.

With what you have.

In the time you can give.

Make your first move today:

- Open that investment account

- Track your last month’s spending

- Cancel a useless subscription

- Read one inspiring book

- Write your financial vision

You don’t need a windfall. You need a direction—and a decision.

This is the beginning of your abundant future.